CapitalStructure for the Desktop

The leading source for accurate, in-depth news and analysis on the European leveraged finance and distressed debt markets.

CapitalStructure’s first-to-market news on and analysis of the European Sub-Investment grade space is complimented by a database of over 6000 comprehensive transactions dating back to January 2000 and a key events calendar tracking company results, new bond issues, loan syndications, consent requests and restructuring timetables.

-

Detailed sub-investment grade transactions database on over 2,250 corporates.

Subscribers can perform a range of analytics on the company database including searching by borrower, country(s), sector(s), equity sponsor(s).

-

Leveraged Loans database with over 3,000 syndications from January 2000

Leveraged Loans primary and secondary market news is supported by an extensive Leveraged Loans database. Subscribers can run comprehensive searches across sector(s), country(s), currency(s), debt instrument(s), transaction type(s), special feature(s), lead managers(s), equity sponsor(s) and more.

-

High Yield database with over 2,900 Issues dating from January 2000

High Yield coverage is supported by New Issue Calendar and a detailed Bond database. Multiple search options are available including sector(s), country(s), currency(s), deal types(s), special feature(s), coupon, leverage, call dates, maturity date and lead managers.

-

Special Situations database with detailed analysis on over 260 credits

Subscribers can access comprehensive tearsheets on Special Situation credits past and present. Access an extensive transaction database containing snapshots of Liability Management exercises and Debt Restructurings from 2007.

-

Structured Finance database containing over 500 deal structures.

Database spans CMBS, ABS, RMBS, WBS, BWICS & CLO’s organised by Issuer with full transaction profiles and Tearsheets on performing, stressed and distressed CMBS.

-

Events Calendar capturing the Leveraged Finance, Special Situations and Structured Finance markets

Subscribers can view upcoming events including company results, expected bond and loan syndication timetables, consent deadlines, restructuring timetables, High Yield bond and Structured Finance loan maturities.

-

Detailed Company Profiles

Comprehensive company profiles supported by a full debt profile, tearsheets for Special Situation credits, and extensive editorial archive and events calendar.

-

Liability Management Snapshots

Concise summaries of Liability Management exercises including pre and post transaction debt structured.

-

Debt Restructuring Summaries

CapitalStructure’s debt restructuring snapshots capture pre and post capital structures and concise summary of the transaction including triggers, implementation structure, levels of writedown, ownership structure, stakeholder committees formed and advisors involved.

-

Content rich editorial archive

Subscribers can search the editorial archive using over 170 pre-defined terms including primary issuance, high yield preview, Advisory mandates, potential event of default, distressed investor interest, CLO issuance and Structured Finance primary issuance.

-

Personalised Alert Profiles

Subscribers can create customised alert profiles to receive alerts based on specific areas of interest or by Universe and then narrow down using pre-defined terms, sector and country. Users can also create a portfolio of companies to follow.

-

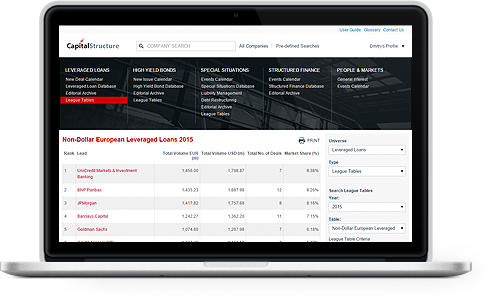

Leveraged Finance & Special Situations Restructuring League tables

Leveraged Loan and High Yield league tables date back to 2007 and Special Situations Restructuring league tables to 2013 ranked by total volume. Institutions are given credit based on total volume. Subscribers can access underlying deal data and transaction profiles and perform a range of analytics.